Zillow fha mortgage calculator

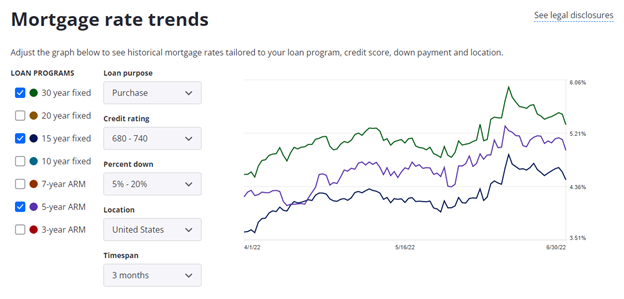

Todays national mortgage rate trends. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week.

![]()

What Is An Fha Loan Complete Guide To Fha Loans Zillow

FHA mortgage calculators compute monthly payments with estimated taxes and insurance and help homeowners safely finance homes.

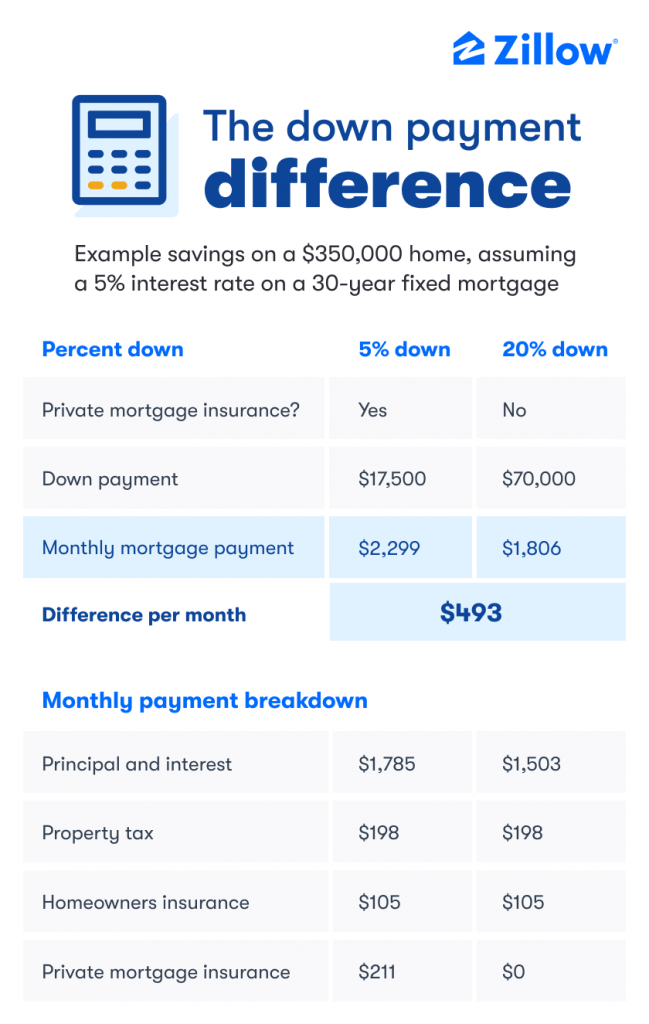

. You can avoid this additional monthly cost by putting 20 down on your home. They include making a larger down payment making smarter decisions as to the neighborhood where you are looking to buy from and trying to reduce. Along with mortgage interest rates each lender has fees and closing costs that factor into the overall cost of the home loan.

Also check California rates daily before acquiring a loan to ensure youre getting the lowest possible rate. 442-H New York Standard Operating Procedures New York Fair Housing Notice TREC. In either case.

30 year fixed FHA. Estimate your taxes and insurance so that these amounts will be included in the payment calculation. There are a few ways you can improve your mortgage amount.

Adjust the fields in the calculator below to. But before you formalize the rate lock. Use a mortgage refinance calculator to determine the breakeven point which is the number of months it takes for the savings to outweigh the.

Use the worksheet indicated to enter estimates for those figures. If you already have a. Rent Open Rent sub-menu.

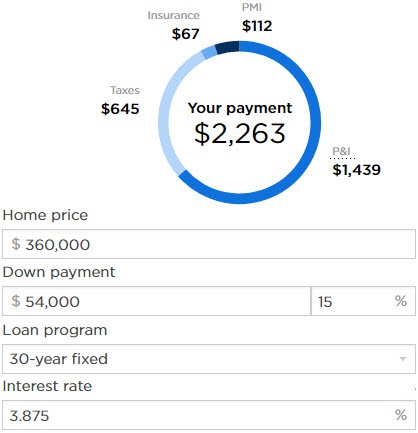

Find great Abilene TX mortgage lending professionals on Zillow like Curt Hale of PrimeLending A PlainsCapital Company. For most conventional loans youre required to pay for private mortgage insurance PMI along with your monthly mortgage payment until your loan-to-value LTV reaches 78-80. With an FHA loan you can expect to pay between 2 and 6 of the home sale price in closing costs.

For example VA loans dont require down payments and FHA loans often allow as low as a 3 down payment but do come with a. Also check Texas rates daily before acquiring a loan to ensure youre getting the lowest possible rate. An FHA loan will come with mandatory mortgage insurance for the life of the loan.

This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgageIf you prefer predictable steady monthly. Use Zillows refinance calculator to determine if refinancing may be worth it. Youll also make a monthly MIP payment throughout the life of your loan or until you refinance to a conventional loan with 20 equity.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Buy and sell with Zillow 360. Mortgage options in Texas.

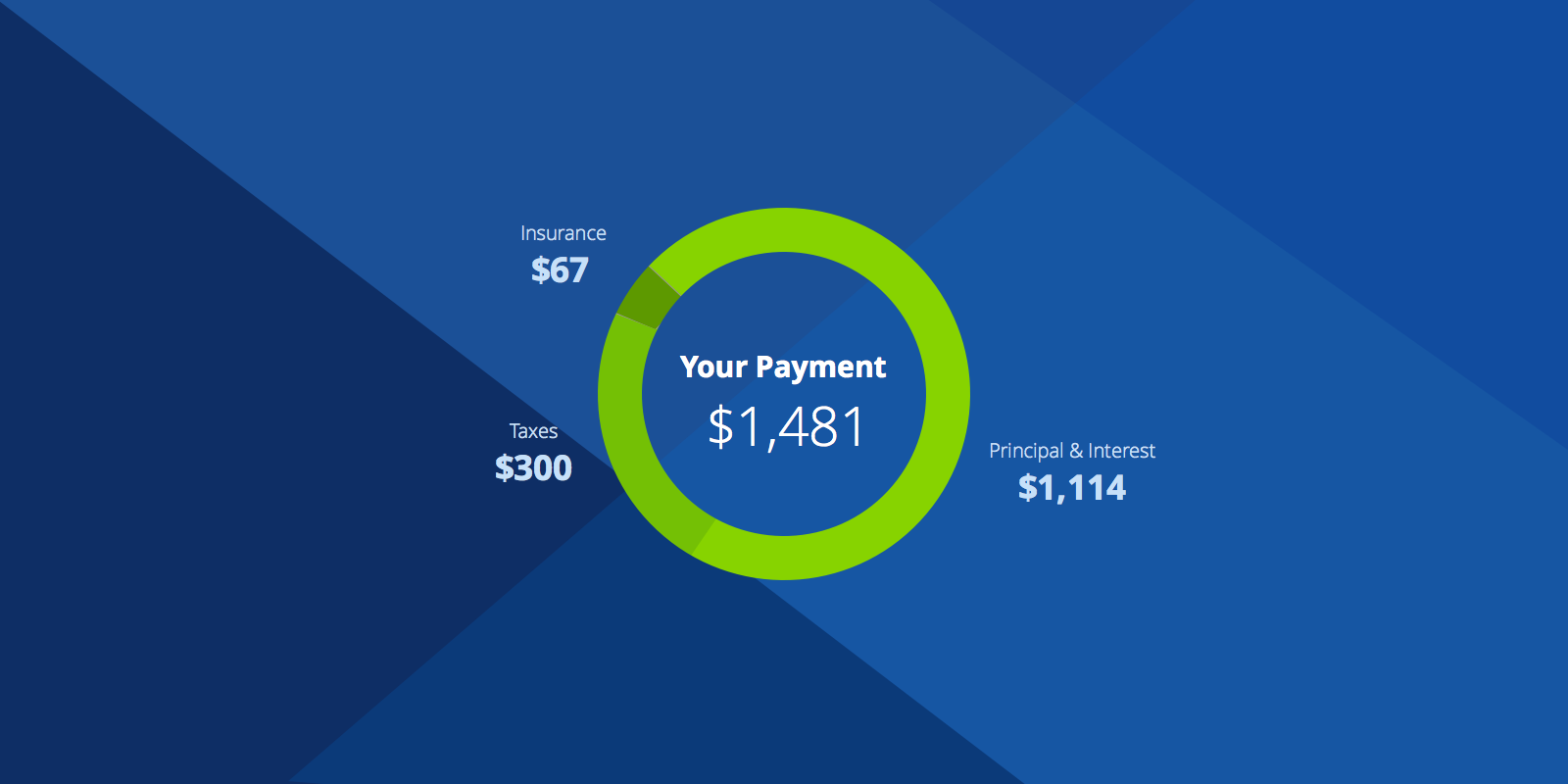

Of course there are exceptions. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. Information about brokerage services Consumer protection notice California DRE 1522444Contact Zillow Inc.

Plano Pkwy Suite 105 Plano TX 75093 Willow Bend Mortgage is an Equal Housing Lender. For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan. If your current first mortgage rate is low you may wish to opt for a second mortgage to keep your low interest rate intact.

Then find a mortgage loan with a good interest rate do your homework online to look at available rates and consider asking your lender to in writing lock in the rate. Closing costs on an FHA loan. If your current mortgage rate is higher than the current market rate you may wish to refinance under a renovation loan or as repaired value cash-out refinance to take advantage of the lower rates.

AL Consumer Credit License 21826 AR Combination Mortgage Banker-Broker-Servicer License 116865 CA Department of Financial. Holds real estate brokerage licenses in multiple provinces. This includes an up-front mortgage insurance premium MIP fee paid at closing.

Enter the details of your existing and future loans to estimate your potential refinance savings. Our mortgage amortization calculator takes into account your loan amount loan term interest rate and loan start date to estimate the total principal and interest paid over the life of the loan. Here is where you enter the additional costs that are typically billed as part of your monthly mortgage payment.

If after using the maximum mortgage calculator you find that you have a mortgage value lower than what you would have liked do not fret. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason. When choosing a lender compare official Loan Estimates from at least three different lenders and specifically pay attention to which have the lowest rate and lowest APR.

Mortgage options in California. Holds real estate brokerage licenses in multiple states. If you already have a.

VA loan government loan. To set yourself up for success and help you figure out how much you can afford get pre-qualified by a licensed Texas lender before you start your home search. Willow Bend Mortgage Company LLC NMLS 117371 is a Texas Limited Liability Company and operates with the following licenses.

Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more. For most people it makes sense to first sign a purchase agreement on a specific property before trying to lock in a mortgage rate. Visit Curt Hales profile on Zillow to read customer ratings and reviews.

The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. Freddie Mac and the National Association of Homebuilders expect mortgage rates to be 3 in 2021 while the National Association of Realtors thinks it will reach 32 and Wells Fargo thinks rates will be 289. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Loan programs and rates can vary by state. Is a 30-year fixed-rate mortgage right for you. Property taxes homeowners insurance homeowners association fees or dues and private mortgage insurance PMI or FHA mortgage insurance if applicable.

The loan program you choose can affect the interest rate and total monthly payment amount. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. Enter amounts in the fields below and the.

To set yourself up for success and help you figure out how much you can afford get pre-qualified by a licensed California lender before you start your home search. Use our mortgage calculator to determine your monthly payment amount. Loan programs and rates can vary by state.

Mortgage Glossary Archive Zillow

Top 20 Mortgage Calculator Tools Startup Stash

5 Alternative Ways To Use A Mortgage Calculator Zillow

Are Mortgage Calculators Accurate Why Some Totally Miss The Mark

What Is A Mortgage And How Does It Work Zillow

How Much Is A Down Payment On A House Zillow

5 Best Mortgage Calculators How Much House Can You Afford

5 Alternative Ways To Use A Mortgage Calculator Zillow

Va Mortgage Calculator Calculate Va Loan Payments

5 Alternative Ways To Use A Mortgage Calculator Zillow

What Is An Fha Loan Complete Guide To Fha Loans Zillow

Piti Principal Interest Taxes Insurance Zillow

How To Get A Reliable Mortgage Rate Quote In 1 Minute

5 Alternative Ways To Use A Mortgage Calculator Zillow

Pre Approval How To Get A Mortgage Pre Approval Zillow

What Is A 30 Year Fixed Rate Mortgage Rate Zillow

Simple Mortgage Calculator Estimate Monthly Payments Moneyunder30